The best place to learn about emerging markets in the 21st century is London in the 19th Century.

The stocks of every nation in the world traded on the London Stock Exchange. In the 1820s, the mining stocks of South America went through the largest bubble between 1720 and 1920, and after South America gained their independence, the countries issued bonds in London which soon crashed. In the 1840s, not only did the railroads of England get their financing in London, but railroads in France, the United States, India and other countries all raised money in London.

It should be remembered that in the early 1800s, the United States was an emerging market. The United States government issued many of its bonds in London. The Confederate States issued bonds backed by cotton during the civil war which eventually became worthless. The larger railroads in the United States relied on London as an important source of capital for connecting the cities of America to each other.

Entrepreneurs in British colonies throughout the world used London as their primary source of capital. Not only did Britain’s colonies raise most of their capital in London (Canada, Australia, New Zealand, India, South Africa and others), but many South American companies (Brazil, Argentina, Chile, and others) saw London as the main market for their stocks. Larger continental companies, especially railroads, raised money in London as well.

The database includes data on bonds as well as stocks. Thousands of bonds from every country in the world, corporations, municipalities, states and others government agencies traded on the London Stock Exchange.

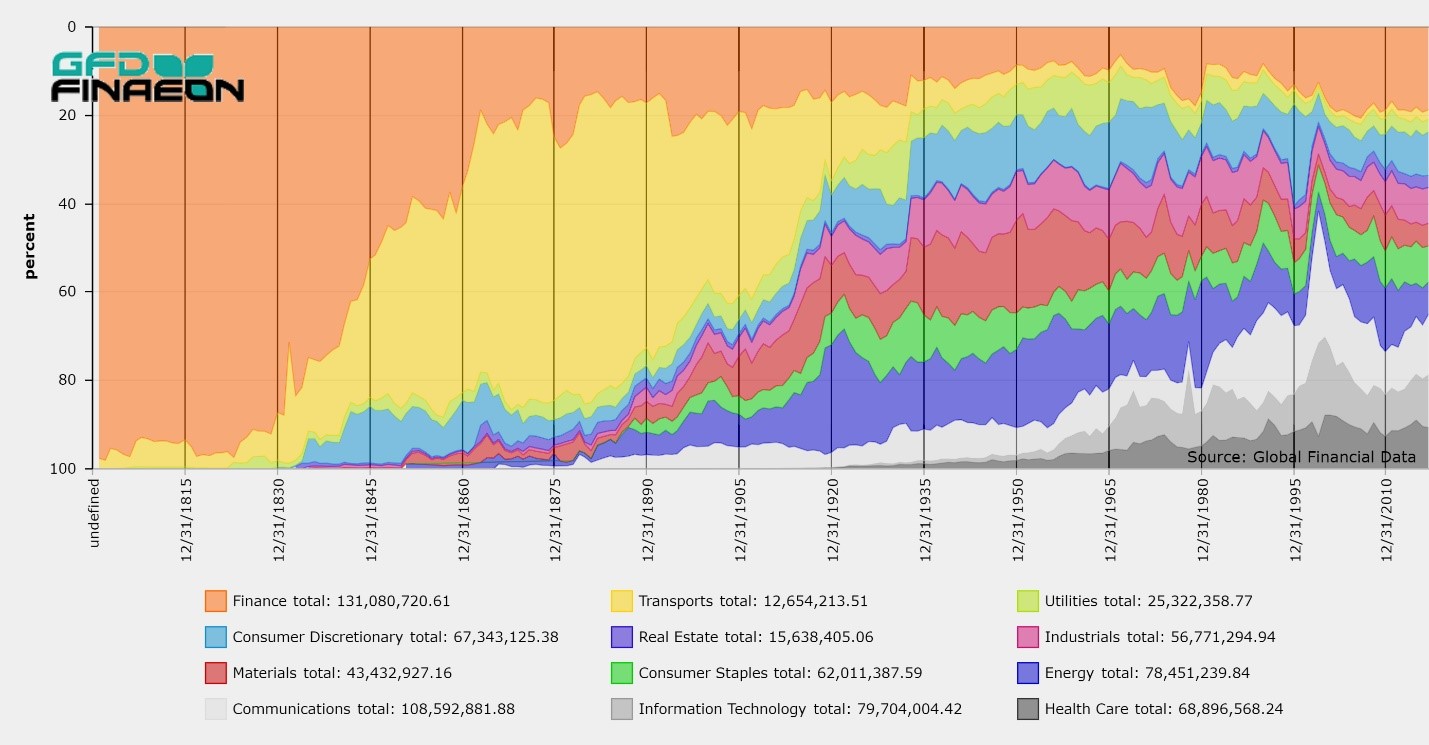

The London Stock Exchange database provides a comprehensive overview of global equities during the 19th and 20th Centuries. Every country in the world was represented on the London Stock Exchange at one time or another.

During the 21st Century, global growth will come from developing countries. China, India, Russia and other countries that were shackled by Communism and Socialism are now integrated into the globalized world economy. To understand how they will perform in the 21st Century, you need to study how countries that are now developed did when they were emerging 100 and 200 years ago.